How do corporate tax cuts influence income tax rates

The landscape of corporate taxation in the United States has dramatically changed over the years, most notably with the implementation of the **Tax Cuts and Jobs Act** in 2017. This act marked a significant shift in the **corp rate**, establishing a flat **corporate rate** of 21%. As such, the act has continued to raise questions regarding its influence on **income tax rates** for individuals, the economy, and public services. Understanding how **tax cuts corporations** have been impacted by these transformations is crucial for grasping the broader implications on fiscal policy and revenue generation.

As corporate tax cuts become a focal point among policymakers, the relationship between corporate taxes and personal income taxes cannot be overlooked. Advocates for raising the **corporate income tax cut** assert that increasing rates for corporations could provide more funding for essential social programs and infrastructure. In contrast, opponents argue that doing so could lead to negative consequences such as **job creation** deficits and a reduction in domestic investment. This article aims to dissect these complex interactions, exploring historical trends and current implications surrounding the debate.

- The History of Corporate Tax in the U.S.

- Overview of the Tax Cuts and Jobs Act

- The Current Corporate Tax Rate: Implications and Effects

- Arguments for Increasing Corporate Tax Rates

- Arguments Against Raising Corporate Taxes

- The Relationship Between Corporate Taxes and Income Tax Rates

- The Impact on Domestic Investment and Job Creation

- The Potential Consequences of Corporate Tax Cuts

- The Global Debate on Minimum Tax Rates

- Conclusion: Navigating Tax Policy and Its Broader Implications

The History of Corporate Tax in the U.S.

The **corporate tax** has a long and storied history in the U.S., having undergone numerous transformations since its inception in 1909. Initially, the U.S. government imposed a **tax cut corporations** rate of just 1% on corporate incomes exceeding $5,000. Over the years, rates fluctuated based on economic conditions and political philosophies. By 1969, the peak rate surged to a staggering 52.8%, reflecting a period when governmental revenues were critical for funding various social programs.

As economic landscapes have shifted, so too have corporate tax rates. The late 20th century saw numerous adjustments, with significant reductions in the 1980s and 1990s under the Reagan and Clinton administrations. Yet, it wasn't until the passage of the **Tax Cuts and Jobs Act** in 2017 that we witnessed a monumental change when the U.S. adopted the flat 21% **corporate rate**. This move was framed as a means to stimulate economic growth and enhance global competitiveness. However, the implications of this change have sparked continuing discussions on equity and revenue generation.

Overview of the Tax Cuts and Jobs Act

The **Tax Cuts and Jobs Act** (TCJA), enacted in December 2017, fundamentally restructured the framework of corporate taxation in the U.S. By reducing the **corporate income tax rate** from a maximum of 35% to a flat 21%, the legislation intended to foster an environment conducive to investment and job creation. This **corporate tax cut** aimed to bring U.S. tax rates more in line with those in other developed countries, thereby minimizing the incentive for corporations to move their operations overseas.

In addition to the reduction in the **corp rate**, the TCJA reformed various aspects of taxation, including the introduction of a territorial system of taxation, which excluded foreign income from U.S. taxes. This approach was designed to encourage corporations to repatriate profits held abroad. However, the legislation also included changes to the **tax cuts corporations** could claim, altering deductions and incentives that previously existed for certain industries.

The Current Corporate Tax Rate: Implications and Effects

Currently, the **corporate rate** stands at 21%, a substantial reduction aimed at revitalizing the economy. Proponents of this tax cut argue that a lower rate stimulates greater investment in capital projects and job creation domestically. Businesses, now able to retain more of their earnings, are expected to reinvest that capital, leading to growth in wages and overall economic expansion. However, the anticipated benefits of this **corporate income tax cut** are far from universally accepted.

Critics argue that the expected surge in investment has been underwhelming. Many corporations have used their tax savings to buy back shares rather than invest in employee wages or capital improvements. This stock buyback trend signals that the benefits of the **tax cut corporations** received may not be translating into the broader job market improvements that proponents envisioned. Furthermore, the long-term effects on public revenue must be considered considering the essential services that depend on corporate contributions to government coffers.

Arguments for Increasing Corporate Tax Rates

Those advocating for a return to a higher **corporate rate** often cite fairness and economic equity as primary reasons. A higher **corporate income tax cut** could generate substantial revenue that could fund public services and infrastructure. As income inequality becomes an increasingly pressing issue, means of redressing this disparity through corporate taxation gain traction.

Increased corporate taxes can also theoretically boost investment in social programs, education, and healthcare, sectors that directly contribute to human capital development. This perspective posits that corporations should contribute a fairer share to the economy from which they derive profit, ensuring that the benefits of their growth are distributed more equitably among the populace.

Arguments Against Raising Corporate Taxes

Conversely, opponents of raising **corporate tax rates** warn that such a move could stifle economic growth and lead to negative repercussions for the job market. The underlying argument is that higher taxes could lead corporations to pass costs onto consumers, reduce wages, or even seek employment opportunities abroad, ultimately harming the labor force and the economy at large.

Many businesses assert that they need the freedom to allocate resources efficiently without the burden of high taxes. They contend that elevated corporate taxes would deter foreign investments, making the U.S. less attractive as a destination for capital inflow. Thus, the fear remains that raising the **corporate rate** could counteract the gains made from previous tax cuts, potentially leading to stagnation or a reduced global competitive edge.

The Relationship Between Corporate Taxes and Income Tax Rates

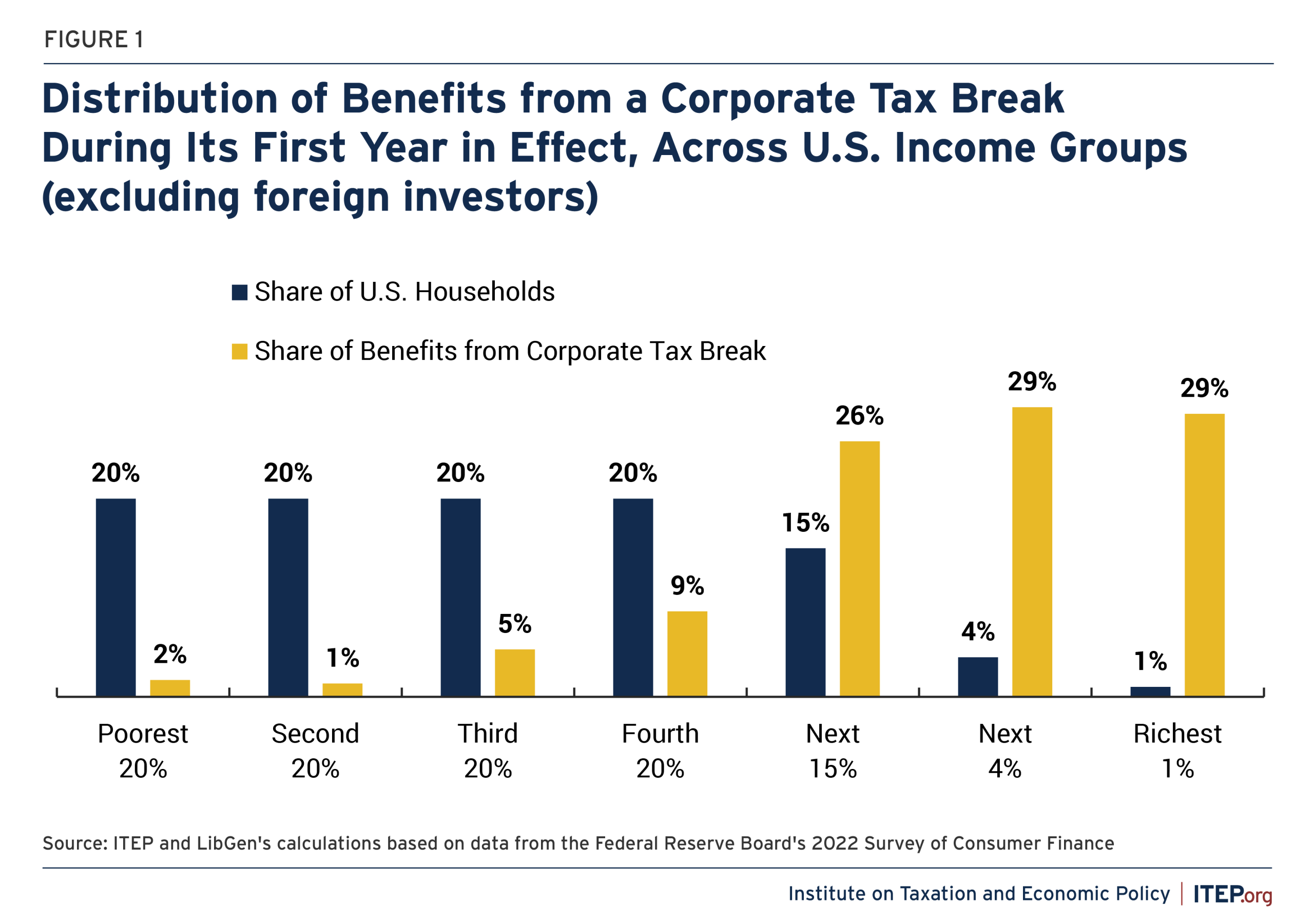

The interaction between **corporate taxes** and **income tax rates** is a vital aspect of fiscal policy that shapes overall economic health. When corporations face higher tax burdens, it can effectively trickle down to individual taxpayers if companies adjust by reducing wages or increasing prices for goods and services. In this way, the **corporate tax cut** strategy has rippling effects through the economy, affecting personal income and the financial stability of households.

Furthermore, a comprehensive examination of corporate taxation must consider how changes in the **corporate income tax cut** can influence public spending. Reduced corporate taxes may lead to budgetary shortfalls, impacting federal and state funding for crucial social services. As debates surrounding tax reform persist, finding a balance between corporate profitability and the sufficiency of public revenue remains a challenging endeavor.

The Impact on Domestic Investment and Job Creation

The long-term agenda of the **Tax Cuts and Jobs Act** was to boost **domestic investment** and job creation through lower corporate taxes. However, the effectiveness of these measures continues to be scrutinized. Supporters argue that lower taxes provide companies with more discretionary income to invest in expansion and workforce development.

Yet empirical evidence appears mixed. Although some companies experienced increased profits post-TCJA, the corresponding surge in job creation has been lackluster. Critics point to the tendency of businesses to utilize tax savings for stock buybacks or to increase dividends rather than directly invest in hiring. The net result has raised doubts about the efficacy of **tax cuts corporations** received as a genuine catalyst for economic growth and job generation.

The Potential Consequences of Corporate Tax Cuts

As we assess the ramifications of **corporate tax cuts**, several potential consequences arise. While the **corporate income tax cut** was designed to spur growth, the actual outcomes reflect a more complicated narrative. Critics indicate that inconsistent reinvestment patterns, alongside shareholder prioritization, can lead to negative long-term economic consequences.

Moreover, a substantive reduction in government revenues from these tax cuts poses issues for budgetary allocations. Essential services such as education and infrastructure may suffer from diminished funding, ultimately stunting broader economic development. Thus, the success of such tax reforms hinges on finding a balanced approach that encourages corporate growth while securing necessary revenue for public investment.

The Global Debate on Minimum Tax Rates

As discussions surrounding domestic **corporate tax** structures evolve, international conversations regarding minimum tax rates for global corporations have gained traction. The objective is to establish a baseline tax rate that multinational corporations must meet, thereby preventing practices of profit shifting and tax avoidance across borders. Such measures aim to level the playing field for businesses operating within differing tax regimes.

The global push for minimum tax rates reflects a growing recognition of the challenges that jurisdictional tax competition presents. Countries may lower their corporate tax rates to attract foreign investments, consequentially leading to a race to the bottom. Advocating for a global minimum tax seeks to ensure that corporations contribute meaningfully regardless of where they are headquartered, providing a more equitable approach to global corporate taxation.

As the U.S. navigates the complexities of **corporate taxation**, it's evident that the implications of tax cuts extend far beyond just corporate profits. The interplay between **corporate tax rates** and **income tax rates** plays a pivotal role in shaping economic policy and determining the fiscal landscape. Debates about raising or lowering these rates will continue as stakeholders assess the balance between encouraging business growth and delivering public resources.

Ultimately, understanding the long-term consequences of corporate tax cuts is essential for fostering sustainable economic growth that benefits all. Policymakers must consider how **tax cuts corporations** have experienced serve as leverage in broader discussions around equity, investment, and economic stability. Addressing these critical issues will require a careful examination of domestic and global tax strategies moving forward.

Did you find this article helpful? How do corporate tax cuts influence income tax rates See more here Education.

Leave a Reply

Related posts