What is the power of buyers in Porter's Five Forces

Understanding the power of buyers in a competitive landscape is crucial for any business striving to maintain or improve its market position. As one of the five forces outlined in Michael Porter’s framework, buyer power serves as a significant determinant of profitability and market dynamics. By analyzing how buyer power affects pricing, product offerings, and overall strategy, businesses can adapt and position themselves to not only meet customer demands but also secure their margins against shifting pressures.

This article delves into the power of buyers as presented in Porter's Five Forces model, exploring its implications for companies across various sectors. By examining the factors that influence buyer power and the strategies businesses can employ to manage this force, investors and business leaders can gain a comprehensive insight into their competitive environment and the pressures that shape their operations.

Understanding Porter's Five Forces

Michael Porter introduced the Five Forces model to help businesses assess the competitive intensity of their industry and identify potential challenges and opportunities. The power of buyers is one of these critical forces that can significantly influence market conditions and the profitability of a company.

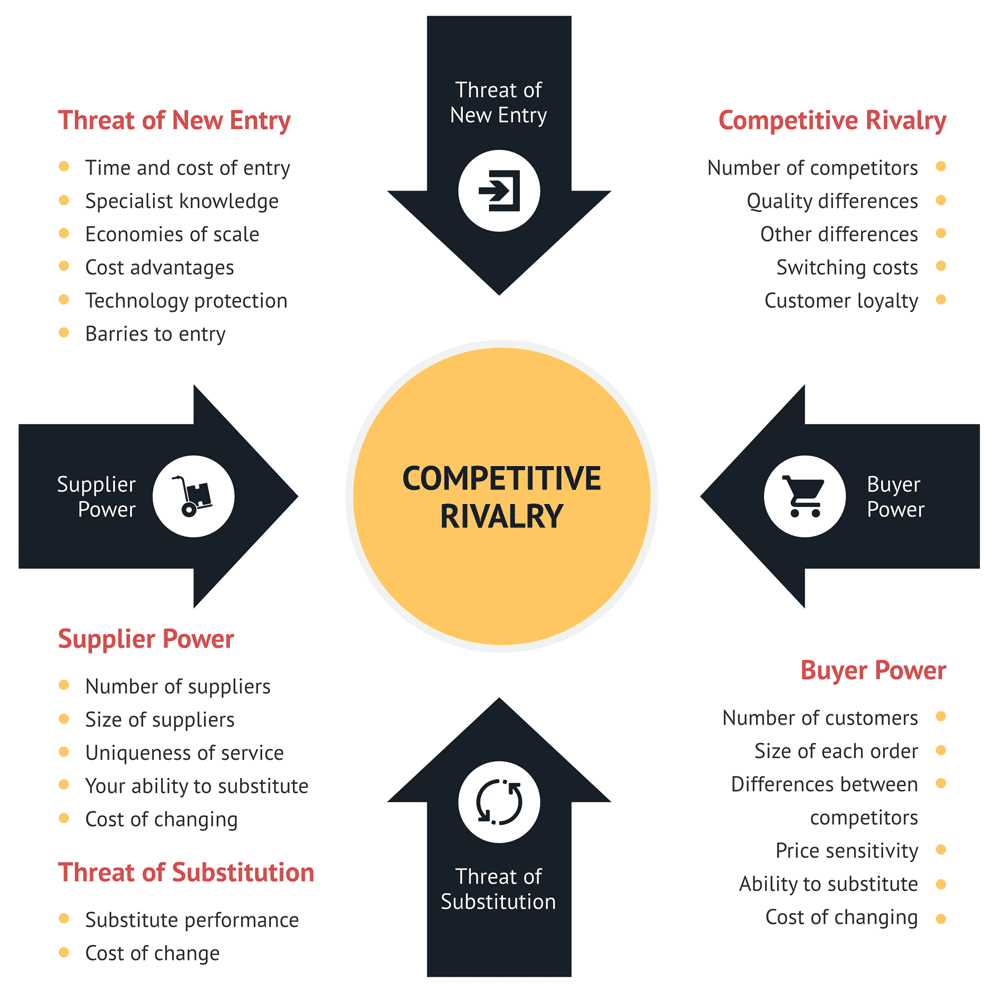

The Five Forces include:

- Competitive Rivalry: The level of competition among existing firms.

- Buyer Power: The influence customers have on the pricing and quality of products.

- Supplier Power: The leverage suppliers have over companies in terms of pricing and availability.

- Threat of Substitutes: The likelihood of customers finding an alternative to a company's product.

- Threat of New Entrants: The risk of new competitors entering the market.

By analyzing these forces, businesses can devise strategies to enhance their competitiveness while addressing the challenges posed by their market environment.

The Role of Buyer Power in Competitive Analysis

The power of buyers refers to the ability of customers to affect pricing and terms, which can have profound implications for a company's profitability. When buyers have significant power, they can demand lower prices, higher quality, and better service, forcing suppliers to adapt.

Understanding buyer power is essential for developing effective marketing and sales strategies. Companies need to evaluate their customer base and determine how much leverage their buyers hold, as this can dictate the balance of power in negotiations and overall strategic planning.

Types of Buyer Power

Buyer power can manifest in various forms, including:

- Price Sensitivity: When buyers are price-sensitive, they are likely to shop around and compare prices, forcing companies to compete aggressively.

- Brand Loyalty: In cases where buyers exhibit strong brand loyalty, companies may have more leeway to set prices without immediate backlash.

- Availability of Alternatives: The more alternatives available to a buyer, the greater their power to demand lower prices or higher quality.

Factors Influencing Buyer Power

Several factors contribute to the overall power of buyers within an industry. These include:

- Concentration of Buyers: If a few large buyers dominate the market, they wield significantly more power.

- Product Differentiation: Less differentiation means that buyers can easily switch between providers, increasing their power.

- Switching Costs: If buyers face low switching costs, they can freely move between suppliers, enhancing their negotiating position.

- Buyer Information: Well-informed buyers who understand their choices can leverage their knowledge to negotiate better deals.

- The Price of Products: If the product's price represents a significant portion of the buyer's total costs, they will be more invested in negotiating better prices.

Implications of High Buyer Power for Companies

High buyer power can lead to several challenges for companies, significantly impacting their profitability and market strategies. Companies may find themselves forced to reduce prices, increase product quality, or enhance service offerings, all of which can squeeze margins. This pressure may also compel firms to innovate or diversify their product lines in response to competitive threats.

Ultimately, the implications of high buyer power extend beyond immediate price negotiations. They can lead to long-term changes in corporate strategy, as companies must navigate a landscape where consumers demand transparency, sustainability, and added value. Failing to adapt could result in losing market share to competitors who are more agile in responding to buyer demands.

Strategies to Manage Buyer Power

To effectively manage the power of buyers, companies can employ several proactive strategies:

- Enhance Product Differentiation: By developing unique products or services, companies can reduce the influence of buyer power.

- Build Strong Relationships: Establishing rapport and trust with customers can make them less price-sensitive and more loyal.

- Improve Customer Experience: Focusing on superior service can create loyalty and mitigate the threat from competitors.

- Diversify the Client Base: A broader customer base can reduce the impact of a few powerful buyers on overall sales.

- Increase Switching Costs: Developing contracts or loyalty programs can make it harder for customers to switch to competitors easily.

Case Studies: Buyer Power in Action

Analyzing real-world cases can provide significant insights into how the power of buyers operates in various industries. Companies often use strategies tailored to specific buyer dynamics, illustrating the adaptability required in competitive markets.

Case Study: Automotive Industry

In the automotive industry, especially during economic downturns, buyers hold enormous power. With numerous manufacturers vying for consumer attention, buyers can easily switch from one car brand to another. For instance, car manufacturers like Ford have responded by enhancing their product quality and introducing financing options to make purchases easier and more attractive to potential buyers.

Case Study: Technology Sector

In the technology sector, companies like Apple have managed to build significant brand loyalty, reducing the power of buyers. Customers are often willing to pay premium prices for Apple products due to their perceived quality and ecosystem compatibility. Conversely, companies that do not achieve similar brand loyalty may find themselves under pressure from more price-sensitive buyers.

Conclusion: Leveraging Buyer Power for Competitive Advantage

Understanding and managing the power of buyers is essential for any company looking to thrive in a competitive environment. By carefully analyzing the factors that influence buyer power and implementing strategies to mitigate its effects, businesses can secure their market position and enhance profitability.

Ultimately, the key lies in understanding the buyer’s perspective and adapting to their evolving demands, thus leveraging buyer power to cultivate competitive advantages rather than viewing it solely as a threat. By doing so, companies can not only survive but thrive in today’s dynamic marketplace.

Did you find this article helpful? What is the power of buyers in Porter's Five Forces See more here Education.

Leave a Reply

Related posts