What are key short-term finance strategies for business success

In the fast-paced world of business, understanding short term finance in business is vital for growth and sustainability. Companies often face the challenge of managing their immediate financial needs while seeking opportunities for expansion and innovation. Implementing effective short-term finance strategies can lead to improved cash flow, operational efficiency, and business resilience.

Short-term finance strategies help businesses navigate the dynamic market landscape by ensuring they have adequate liquidity to cover immediate obligations. By focusing on a combination of cash flow management, effective inventory control, and resourcefulness in funding sources, companies can maintain stability and capitalize on new opportunities that arise. This article delves into key short-term finance strategies that can lead to business success.

- Understanding Short-Term Finance

- Importance of Cash Flow Management

- Identifying Funding Sources

- Strategies for Efficient Inventory Management

- Leveraging Trade Credit

- Utilizing Factoring and Invoice Financing

- Managing Operational Costs

- Implementing Dynamic Pricing Strategies

- The Role of Financial Forecasting

- Conclusion: Building a Sustainable Financial Future

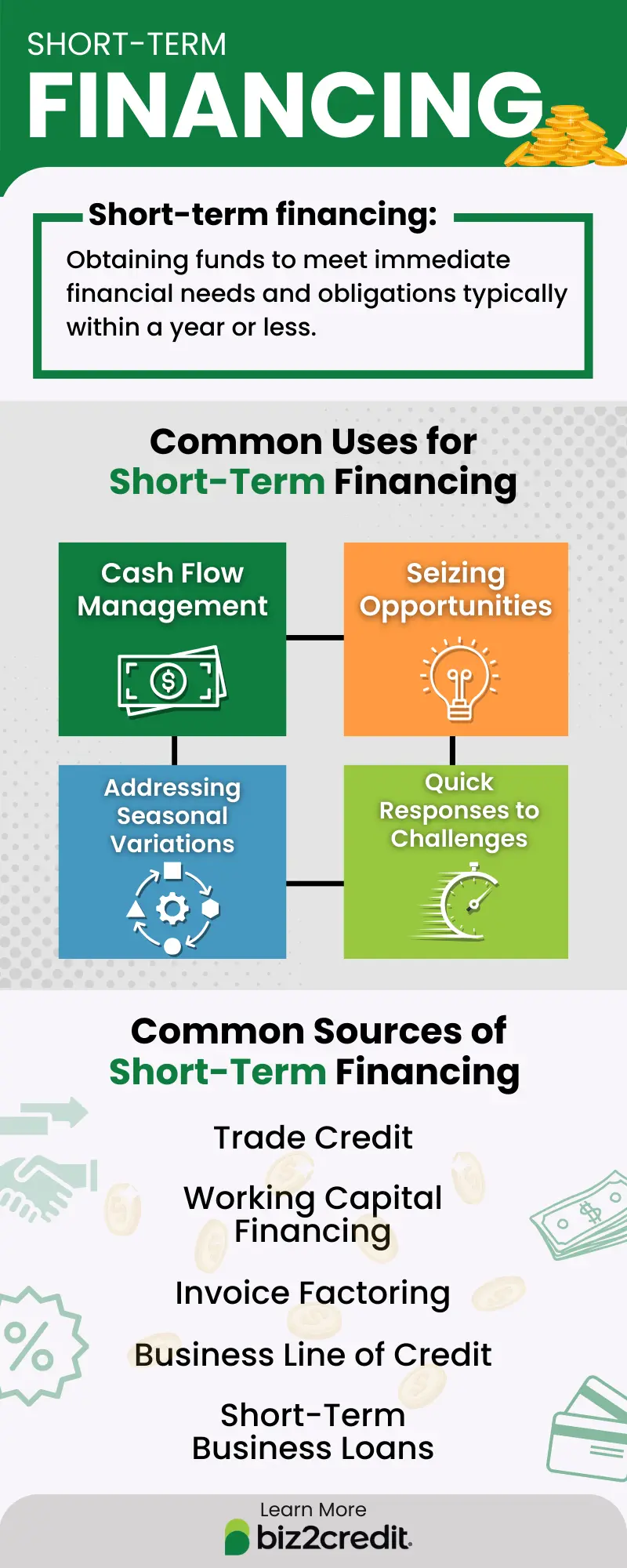

Understanding Short-Term Finance

Short term finance in business refers to financial solutions that cater to immediate financing needs, typically for a duration of up to one year. This type of financing is crucial for businesses to cover their operating expenses, manage unforeseen economic fluctuations, and maintain liquidity. Understanding the nuances of short-term finance is essential for leaders to optimize their operational performance.

In many cases, short-term financing avenues include lines of credit, working capital loans, and business credit cards. Each of these options is designed to provide quick access to funds that can help keep the business operational during critical times. Effectively navigating short-term finance allows businesses to invest in growth while safeguarding against cash flow crises.

Importance of Cash Flow Management

Cash flow management is fundamental in any business operation. It involves tracking, analyzing, and optimizing the amount of cash coming in and out of the business. A well-structured cash flow management system ensures that a company maintains adequate liquidity, enabling it to meet its financial obligations without delays.

For businesses, the ability to forecast cash flow accurately can significantly impact their long-term sustainability. By creating cash flow projections, businesses can identify potential shortfalls in advance and develop contingency plans. This proactive approach to short term finance in business can mitigate risks associated with unexpected expenses or loss of revenue.

Identifying Funding Sources

Identifying diverse funding sources is critical for businesses looking to implement short term finance in business. Various funding options should be explored, including traditional bank loans, peer-to-peer lending, angel investors, and personal savings. Additionally, businesses may also consider government grants and incentives that can enhance their liquidity.

Adapting to market conditions and exploring different funding sources can equip businesses with the necessary resources to operate successfully. Maintaining a strong relationship with lenders is also crucial; they can provide timely assistance when short-term financing needs arise.

Strategies for Efficient Inventory Management

Efficient inventory management is key to ensuring that a company's cash flow remains healthy. By reducing excess inventory and adopting just-in-time inventory practices, businesses can free up capital that would otherwise be tied up in stock. Utilizing inventory management systems can provide real-time data on stock levels, enabling decision-makers to react promptly to changing demands.

Implementing these strategies should help businesses avoid overstocking and understocking situations. This will ultimately lead to more efficient use of resources and better positioning when it comes to employing short term finance in business.

Leveraging Trade Credit

Trade credit is an option that many businesses overlook, yet it can be an invaluable component of short term finance in business. By negotiating favorable payment terms with suppliers, businesses can extend their payment timelines and conserve cash flow. This essentially allows companies to use their suppliers' capital for their operational needs without incurring high interest rates associated with bank loans.

Building strong vendor relationships can enhance a business’s ability to leverage trade credit effectively. Establishing a reputation for timely payments can also encourage suppliers to offer better terms, providing businesses with more flexibility in their financial management.

Utilizing Factoring and Invoice Financing

Factoring and invoice financing are additional methods that can assist businesses in addressing their short-term financing needs. Factoring involves selling accounts receivable to a third party at a discount, providing immediate cash flow. Invoice financing allows businesses to access a percentage of their unpaid invoices, effectively turning delayed payments into working capital.

These financing solutions can help businesses cover operational costs while awaiting customer payments, improving overall liquidity and enabling better management of short term finance in business.

Managing Operational Costs

To optimize short term finance in business, managing operational costs is essential. This can be achieved through a comprehensive review of expenses and focusing on areas where savings can be realized. Implementing cost-saving measures, such as renegotiating contracts with suppliers, outsourcing non-core functions, and automating processes, can significantly impact a business’s bottom line.

By effectively managing operational costs, businesses can allocate resources towards growth initiatives, thus enhancing their competitive advantage and financial position in the market.

Implementing Dynamic Pricing Strategies

Dynamic pricing strategies involve adjusting prices based on market demand, competition, and consumer behavior. By utilizing data-driven insights, businesses can set prices that maximize profitability while remaining attractive to consumers. This flexibility is particularly important in industries where preferences shift rapidly or when supply chain constraints affect product availability.

Implementing a dynamic pricing strategy not only enhances revenue but also supports a business’s approach to short term finance in business by ensuring that income aligns closely with real-time market conditions.

The Role of Financial Forecasting

Financial forecasting plays a critical role in planning for short-term financing needs. By analyzing historical financial data and projecting cash flow, expenses, and revenues, businesses can create informed strategies to navigate uncertainty and capitalize on opportunities. Effective financial forecasting allows businesses to adjust operations according to expected market conditions.

Incorporating robust forecasting practices into the business strategy can improve decision-making and provide a solid foundation for effective short term finance in business. It allows businesses to be proactive rather than reactive in their financial management.

Conclusion: Building a Sustainable Financial Future

In conclusion, implementing key short term finance in business strategies is pivotal for every organization seeking growth and stability. From efficient cash flow management and focused inventory control to leveraging diverse funding sources and utilizing dynamic pricing, the strategies outlined in this article provide a roadmap for success.

By prioritizing these strategies, businesses can not only navigate the complexities of their daily operations but also build a sustainable financial future. Adapting to market changes, leveraging available resources, and forecasting effectively will ensure that organizations remain competitive in an ever-evolving economic landscape.

Did you find this article helpful? What are key short-term finance strategies for business success See more here General.

Leave a Reply

Related posts