Top Choices for Student Loan Refinancing at Credit Unions: Save Money and Lower Your Rates

- Understanding Student Loan Refinancing: Why Choose Credit Unions?

- Top Credit Unions for Student Loan Refinancing: A Comprehensive Review

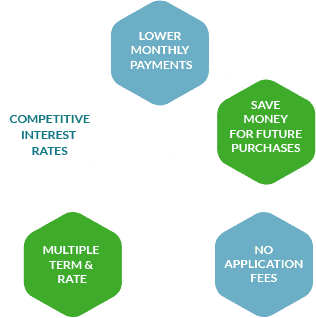

- Key Benefits of Refinancing Your Student Loans at Credit Unions

- How to Choose the Best Credit Union for Student Loan Refinancing

- Comparing Interest Rates: Credit Unions vs. Traditional Lenders for Student Loans

Understanding Student Loan Refinancing: Why Choose Credit Unions?

Refinancing student loans can be a strategic move for borrowers looking to lower their interest rates, reduce monthly payments, or simplify their financial obligations. While there are various lenders in the market, credit unions often stand out as a compelling option for refinancing. One of the primary reasons to consider credit unions is their member-focused approach, which typically translates to better rates and more personalized service.

Competitive Interest Rates

Credit unions are not-for-profit organizations, meaning they prioritize their members over profit margins. This structure allows them to offer competitive interest rates on student loan refinancing compared to traditional banks. By choosing a credit union, borrowers can potentially save hundreds, if not thousands, of dollars over the life of their loan.

Flexible Terms and Conditions

Another advantage of refinancing through credit unions is the flexibility in terms and conditions. Many credit unions provide tailored refinancing options that cater to individual financial situations. Borrowers can often choose from various repayment terms, allowing them to select a plan that aligns with their financial goals. Additionally, credit unions may offer forbearance options and other supportive measures in times of financial hardship, which can be crucial for students entering the workforce.

Personalized Customer Service

Credit unions pride themselves on their community-oriented values, which often translates to superior customer service. Members can expect a more personalized experience when seeking refinancing options, with loan officers who take the time to understand their unique financial situations. This level of service can make a significant difference in navigating the complexities of student loan refinancing, ensuring borrowers feel supported throughout the process.

In summary, choosing a credit union for student loan refinancing can provide substantial financial benefits, including lower interest rates, flexible terms, and exceptional customer service tailored to individual needs.

Top Credit Unions for Student Loan Refinancing: A Comprehensive Review

When it comes to refinancing student loans, credit unions often provide competitive rates and personalized service that can significantly benefit borrowers. Unlike traditional banks, credit unions are member-owned, which allows them to offer lower interest rates and reduced fees. This comprehensive review highlights some of the top credit unions that excel in student loan refinancing, making it easier for borrowers to manage their educational debt.

Navy Federal Credit Union is renowned for its excellent refinancing options tailored to military members and their families. They offer fixed and variable rates, along with a range of repayment terms. Members can benefit from no origination fees and flexible payment plans, making it an attractive choice for those looking to streamline their student loans.

2. PenFed Credit Union

PenFed Credit Union stands out with its competitive interest rates and no prepayment penalties. Their refinancing program allows borrowers to consolidate federal and private loans into one manageable payment. Additionally, they offer various repayment terms, enabling borrowers to choose the option that best fits their financial situation.

3. Alliant Credit Union

Alliant Credit Union provides a user-friendly online application process and offers low fixed rates for student loan refinancing. Members can also enjoy interest rate discounts for automatic payments. With a strong commitment to customer service, Alliant ensures that borrowers have the support they need throughout the refinancing process.

4. Langley Federal Credit Union

Langley Federal Credit Union is another excellent option for student loan refinancing. They offer no application fees and a variety of loan terms, allowing borrowers to customize their repayment plans. Their focus on member education helps borrowers understand their options, making it easier to make informed decisions about refinancing their student loans.

By exploring these top credit unions, borrowers can find favorable terms and conditions that cater to their specific needs, ultimately easing the burden of student loan debt.

Key Benefits of Refinancing Your Student Loans at Credit Unions

Refinancing your student loans at credit unions can offer several distinct advantages over traditional banks or online lenders. One of the primary benefits is the potential for lower interest rates. Credit unions are not-for-profit institutions, which means they often pass on savings to their members in the form of more competitive rates. This can lead to significant savings over the life of your loan, making it easier to manage your finances and pay off your debt faster.

Another key benefit is the personalized service that credit unions provide. Unlike larger financial institutions, credit unions tend to prioritize member relationships, offering tailored solutions that meet individual financial needs. This personalized approach can result in more flexible repayment options and terms, making it easier for borrowers to find a plan that fits their budget and lifestyle. Credit unions often have a more straightforward application process, ensuring that members receive the support they need throughout the refinancing journey.

Additional benefits of refinancing at credit unions include:

- Lower Fees: Many credit unions charge fewer or no fees compared to traditional lenders, reducing the overall cost of refinancing.

- Community Focus: Credit unions often have a strong community focus, which can lead to more understanding and accommodating lending practices.

- Membership Perks: Members of credit unions may enjoy additional benefits such as financial education resources, budgeting tools, and access to workshops.

Lastly, credit unions often have a reputation for better customer service. With a focus on community and member satisfaction, they typically offer more accessible support channels, allowing borrowers to get answers to their questions quickly and efficiently. This can be especially beneficial for individuals who are new to the refinancing process and may need guidance navigating their options. Overall, refinancing student loans at credit unions can be a smart financial decision that enhances your borrowing experience.

How to Choose the Best Credit Union for Student Loan Refinancing

When it comes to refinancing student loans, selecting the right credit union can make a significant difference in your financial future. Credit unions often offer lower interest rates and more personalized service compared to traditional banks, making them an attractive option for many borrowers. To ensure you choose the best credit union for your needs, consider the following key factors.

1. Interest Rates and Terms

Start by comparing the interest rates offered by different credit unions. Look for credit unions that provide competitive rates, as even a small difference can save you thousands over the life of the loan. Additionally, examine the terms of the loans, including repayment periods and any potential fees. A flexible repayment plan can make it easier to manage your finances post-graduation.

2. Membership Requirements

Credit unions often have specific membership criteria that you must meet to qualify for their services. This can include being a member of a particular organization, living in a certain area, or working for specific employers. Before you dive into the refinancing process, make sure you understand the membership requirements of the credit unions you are considering.

3. Customer Service and Support

Good customer service is crucial when dealing with financial matters. Research the reputation of the credit unions you are interested in by reading customer reviews and ratings. Look for institutions that offer robust support, whether through in-person branches, online chat, or customer service hotlines. Having access to knowledgeable representatives can make the refinancing process smoother and less stressful.

4. Additional Benefits and Features

Many credit unions offer perks that can enhance your borrowing experience. Look for features such as autopay discounts, financial education resources, or loyalty programs. These additional benefits can provide you with added value and help you make the most informed decisions about your student loan refinancing.

Comparing Interest Rates: Credit Unions vs. Traditional Lenders for Student Loans

When considering student loans, one of the most critical factors borrowers must evaluate is the interest rate. Both credit unions and traditional lenders offer student loans, but their interest rates can vary significantly. Typically, credit unions are known for providing lower interest rates compared to traditional banks and financial institutions. This difference is primarily due to their nonprofit status and member-focused approach, allowing them to pass on savings to borrowers.

Credit Unions: Credit unions often offer variable and fixed interest rates that can be more competitive than those provided by traditional lenders. For instance, many credit unions set their rates based on the borrower’s creditworthiness and financial history, which can lead to lower rates for those with good credit. Additionally, some credit unions have specific programs aimed at students, which may include lower interest rates or discounts for autopay enrollment.

Traditional Lenders: On the other hand, traditional lenders, such as banks and online financial institutions, may offer a broader range of loan products and potentially higher interest rates. While they can provide competitive rates, especially for borrowers with excellent credit, they often have higher starting rates and less flexibility in terms of repayment options. It’s also important to note that traditional lenders might charge additional fees, such as origination fees, which can increase the overall cost of borrowing.

When comparing interest rates between credit unions and traditional lenders, it’s crucial to look beyond just the numbers. Consider the overall loan terms, including repayment options, fees, and potential benefits like deferment or forbearance. Borrowers should also assess their eligibility for membership in credit unions, as this can influence their ability to access more favorable loan terms. Understanding these nuances can help students make informed decisions about their financing options.

Did you find this article helpful? Top Choices for Student Loan Refinancing at Credit Unions: Save Money and Lower Your Rates See more here General.

Leave a Reply

Related posts