What is Payment Understanding Basics and Types Explained

In today's fast-paced world, understanding payments is a crucial aspect of both personal and business financial management. From everyday transactions at your local grocery store to complex commercial dealings between corporations, what's payment is an underlying concept that affects us all. With the evolution of technology and payment methods, being informed about the various forms of payments and their respective functionalities is essential for effective financial decision-making.

This article aims to demystify the basics of payments by exploring their definitions, importance, and various types. Understanding the anatomy of a payment transaction, key terms involved, legal requirements, and timing will equip you with the knowledge needed for better transactions. Whether you are an individual making personal purchases or a business entity engaging in larger commercial transactions, mastering payment principles is vital.

- Understanding Payment: Definition and Importance

- The Anatomy of a Payment Transaction

- Key Terms in Payment: Debtor and Creditor

- Legal Requirements for Effective Payments

- Types of Payments: Cash, Digital, and More

- Commercial Transactions: How Payments Fit In

- Contracts and Payments: The Legal Framework

- Timing and Place: When and Where Payments Matter

- Conclusion: Mastering Payment Basics for Better Transactions

Understanding Payment: Definition and Importance

A payment is essentially the act of discharging a monetary obligation, satisfying debts owed between parties. In the simplest terms, it involves the transfer of money or equivalent value from a debtor (the person owing the money) to a creditor (the person receiving the money). Understanding the significance of payment extends beyond mere transactions; it is a fundamental component of economic activity. Each payment contributes to the circulation of money within the economy, facilitating trade and supporting growth. Without effective payment systems, commerce would be hindered.

The importance of understanding payment cannot be overstated. It not only helps individuals manage their finances but also enables businesses to maintain cash flow, negotiate better terms, and establish credibility with partners and customers. Thus, grasping the fundamentals of what constitutes a payment and its nuances is critical for overall financial literacy.

The Anatomy of a Payment Transaction

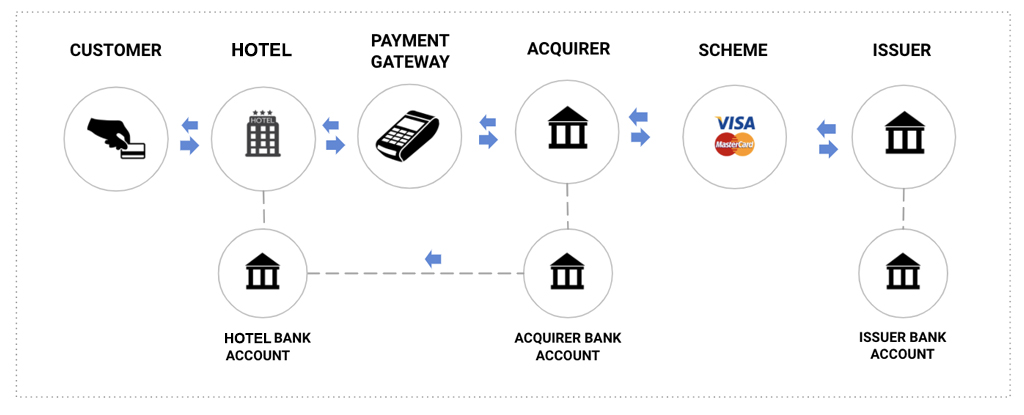

To fully grasp what's payment, one must break down the intricacies of a payment transaction. A typical transaction involves several components: the payer, the payee, the payment method, and the underlying agreement or contract. The payer is the individual or entity that initiates the payment, while the payee is the recipient of the funds. The payment method can vary widely—ranging from cash and checks to digital payments and direct bank transfers.

Each transaction is initiated based on an agreement between the parties involved. This agreement could be a contract for goods or services or a more informal arrangement. Understanding these components helps in identifying the roles each party plays in the transaction, as well as the implications of how payments are made.

Key Terms in Payment: Debtor and Creditor

When navigating the world of payments, two key terms frequently arise: debtor and creditor. The debtor is the party that owes a payment, whether for a loan, goods purchased, or services rendered. On the other hand, the creditor is the entity that extends credit or provides a service with the expectation of receiving payment.

Understanding the relationship between debtor and creditor is vital in grasping payment dynamics. The obligations and rights of each party can vary significantly depending on the nature of the transaction. Legal frameworks often define these relationships, ensuring that transactions are executed fairly and obligations are fulfilled.

Legal Requirements for Effective Payments

Effective payments are not just about transferring money; they also require adherence to specific legal requirements. For a payment to be deemed effective, it must occur at the agreed-upon time and place. Furthermore, payments must be executed in an appropriate manner that aligns with the contractual terms set by the parties involved.

Different jurisdictions may have varying laws governing payments, including regulations relating to contract formation, consumer protection, and anti-money laundering measures. Therefore, it is crucial for individuals and businesses alike to be aware of the legal aspects under which their payments operate. Not only does this ensure compliance, but it also mitigates the risk of disputes arising from misunderstandings about payment obligations.

Types of Payments: Cash, Digital, and More

Payments can be categorized into several types, each with unique characteristics and uses. Understanding these types is essential for anyone looking to make informed decisions about financial transactions. The most traditional form of payment is cash, used globally for its simplicity and universal acceptance. However, the rise of technology has led to the emergence of numerous digital payment options.

- Credit and Debit Cards: Widely accepted and convenient, cards allow users to make purchases without physical cash.

- Mobile Payments: Services like Apple Pay and Google Wallet leverage smartphones to execute transactions.

- Cryptocurrencies: Digital currencies like Bitcoin offer a decentralized, secure method of payment.

- Bank Transfers: Direct transfers between banks can facilitate larger transactions, often used in business contexts.

Each type of payment comes with its own set of benefits and challenges. It is essential for users to understand these nuances to choose the most suitable payment method for their needs. Additionally, with the continuous evolution of payment technologies, staying updated on the latest trends and options is equally important.

Commercial Transactions: How Payments Fit In

In commercial transactions, the flow of payments plays a critical role in maintaining healthy business operations. Payments serve as the lifeblood of commercial activity, impacting everything from purchasing raw materials to settling invoices for services rendered. In business settings, payment terms negotiated between trading partners directly influence cash flow management and sustainability.

Typically, businesses will enter into contracts that define payment terms, including the amount, method, timing, and conditions under which payments are to be made. Understanding these aspects is essential for mitigating risks and ensuring collaboration and trust among business partners. The absence of clear payment terms can lead to disputes, financial strain, and damage to business relationships.

Contracts and Payments: The Legal Framework

The intersection of contracts and payments is where legal obligations manifest. A contract serves as a formal agreement between parties about what is expected in terms of deliverables and payment. To ensure that a payment effectively discharges a debt, the terms outlined in the contract must be clear and adhered to by all parties involved.

Common elements of contracts include the parties' identities, obligations regarding payment, conditions for fulfilling those obligations, and recourse in the event of non-payment. Understanding this legal framework provides a safety net for both creditors and debtors, fostering a sense of assurance and minimizing the risk of financial losses.

Timing and Place: When and Where Payments Matter

Timing and place are vital considerations in the realm of payments. For a payment to be effective, it needs to be made at the right time, as defined by the contract between the parties. Failure to meet these timing requirements can result in late fees, penalties, or even legal action.

The location of the payment also plays a crucial role, particularly in cross-border transactions. Different jurisdictions have regulations governing when and how payments can take place, which can complicate international trade. Understanding the importance of timing and place ensures that both parties fulfill their obligations accurately and can lead to smoother transaction processes.

Conclusion: Mastering Payment Basics for Better Transactions

Understanding the basics of payment is fundamental to navigating both personal and commercial financial landscapes. From grasping the definitions and importance of payment to exploring the types and legal frameworks involved, knowledge is power in this domain. By knowing what's payment and its key components, you can enhance your financial decision-making and cultivate better transactions.

As payment methods continue to evolve, staying informed on the latest trends and legal requirements will enable individuals and businesses to adapt effectively. With this comprehensive understanding, you will be well-positioned to manage your payment obligations confidently and navigate the complexities of financial interactions in today’s economy.

Did you find this article helpful? What is Payment Understanding Basics and Types Explained See more here Education.

Leave a Reply

Related posts